Carrying credit card debt feels like dragging a weight that never gets lighter — especially when interest keeps piling up.

In 2025, the average U.S. household owes over $7,500 in credit card balances, and with APRs hovering around 22–28%, paying only the minimum can take decades.

But here’s the good news: with the right plan and a few strategic moves, you can eliminate that debt faster than you think — without starving your wallet or ruining your lifestyle.

Let’s break down exactly how.

1. Know Your Numbers First

Before you can fix the problem, you need a clear picture of it.

Grab a notepad or spreadsheet and list:

- Each credit card’s balance

- Interest rate (APR)

- Minimum payment

- Due date

This gives you your starting point.

Seeing it all in one place might feel uncomfortable — but it’s the first step to taking control.

💡 Tip: Use free tools like Credit Karma, Mint, or Empower to automatically track balances and due dates.

2. Stop Adding New Debt

It’s like trying to empty a bathtub with the faucet still running.

Commit to no new charges until your balance is gone.

- Use cash or debit for essentials.

- Freeze or store your cards temporarily.

- Delete saved card info from online stores.

If you can’t resist temptation, try a digital envelope system (apps like YNAB or Goodbudget) to manage your spending.

3. Choose a Payoff Strategy: Avalanche vs. Snowball

Two proven methods can help you destroy debt faster:

🧊 Avalanche Method

- Focus on paying off the highest-interest debt first.

- You’ll save the most money on interest overall.

Example:

If Card A has 27% APR and Card B has 18%, throw every extra dollar at Card A first.

❄️ Snowball Method

- Focus on the smallest balance first.

- Each victory builds momentum and motivation.

Example:

If you owe $400, $1,000, and $2,500, pay off the $400 first to get that psychological win.

📊 Most effective: The avalanche saves more money; the snowball keeps you emotionally engaged.

Pick the one you’ll actually stick with.

4. Negotiate Lower Interest Rates

Most people don’t realize it, but you can actually call your credit card company and ask for a lower APR.

If you’ve been a long-time customer with decent payment history, they’ll often agree — especially if you mention competitors offering better terms.

💬 Example script:

“I’ve been a loyal customer for years and have always paid on time. I’d like to stay with your company, but my APR is higher than average. Could you lower it by a few points?”

Even a 3% rate reduction can save hundreds of dollars per year.

5. Consolidate or Refinance Your Debt

If you have multiple cards with high interest, consider merging them into one lower-rate payment.

Options include:

- Balance transfer cards with 0% APR for 12–18 months.

- Personal loans at fixed, lower rates.

- Credit union refinancing programs for members.

⚠️ Be careful: Avoid using the freed-up cards again. The goal is to simplify, not reset the cycle.

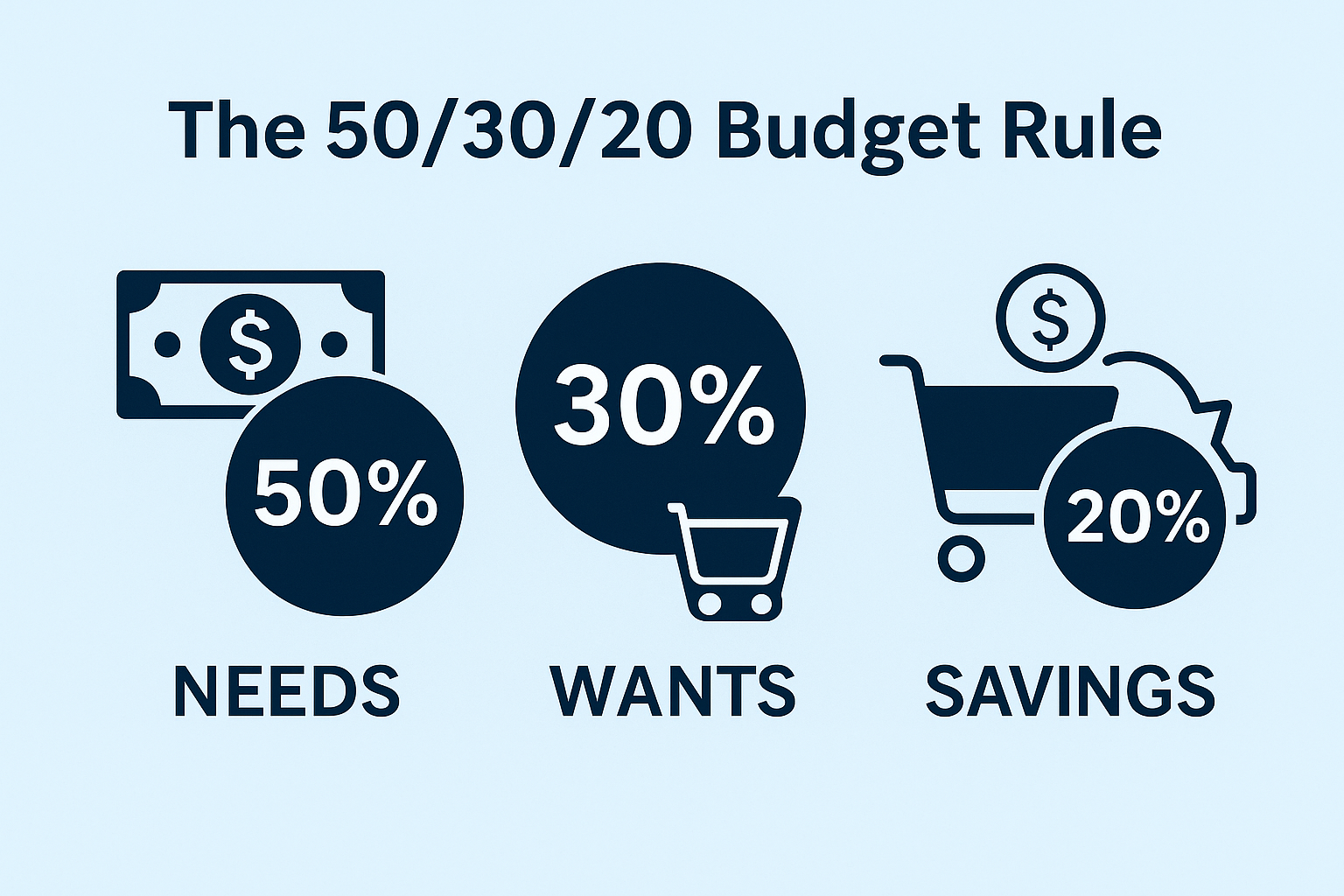

(Related: The 50/30/20 Budget Rule Explained for Beginners)

6. Automate Payments and Boost the Minimum

Always pay at least the minimum on time, but automate slightly higher payments if you can.

💰 Example:

If your minimum is $100, set an automatic $125 payment — that extra $25 goes directly toward principal, not interest.

Small consistent overpayments can shave months off your timeline.

7. Increase Cash Flow (Even Slightly)

You don’t need a second job — just a small, steady boost in income to speed things up.

Ideas for 2025 side cash:

- Freelance gigs (Upwork, Fiverr)

- Renting tools, cameras, or rooms on platforms like Fat Llama or Airbnb

- Selling digital products or templates

- Using cashback and reward apps

Even $100 extra a month can drastically accelerate your debt payoff.

8. Track Progress and Celebrate Wins

Debt payoff is a marathon, not a sprint.

Celebrate every milestone — every $500 or $1,000 paid down deserves recognition.

📈 Try visual tools like debt trackers or progress bars (available in free Excel templates).

Seeing your balance shrink keeps motivation alive.

Final Thought

Paying off credit card debt fast in 2025 isn’t about luck — it’s about focus, strategy, and discipline.

You don’t have to live on noodles or cancel every joy.

You just need a plan that makes your money work harder than your interest rate.

Start small, stay consistent, and remember: the feeling of being debt-free is worth more than any reward points ever will.

(Also read: 10 Smart Ways to Save Money Without Feeling Restricted

Pingback: How to create a monthly budget that works in 2025

Pingback: low-income budget hacks that actually work in 2025

Pingback: Living Paycheck to Paycheck: How to Break the Cycle in 2025