Getting rich isn’t about luck, timing, or earning six figures — it’s about habits.

The people who quietly build wealth don’t usually win the lottery or invent the next big app.

They build it slowly, consistently, and intentionally.

The truth is, financial success is 80% behavior and 20% knowledge.

So if you want to grow your wealth in 2025 and beyond, it starts with developing the right habits — one paycheck at a time.

Let’s explore 7 proven financial habits that can make you rich over time.

1. Spend Less Than You Earn (Always)

It sounds simple, but it’s the foundation of financial success.

You can’t invest, save, or pay off debt if every month ends at zero — or worse, negative.

💡 The golden rule:

“Live below your means so your money can work above them.”

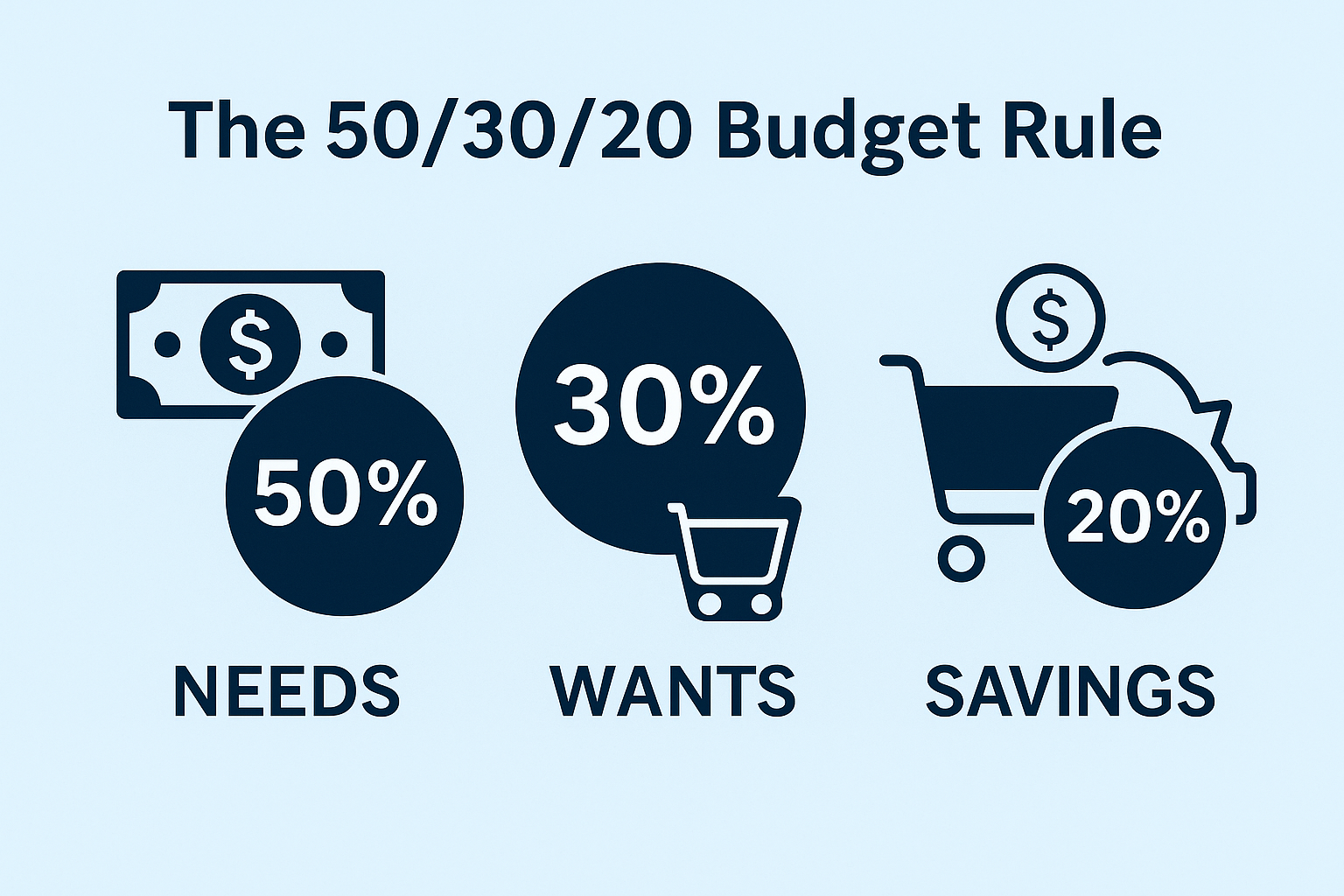

Start by tracking every expense for 30 days. You’ll be surprised where your money leaks — subscriptions, impulse buys, “little” daily costs that add up.

Then set a realistic spending cap that leaves room for savings and investing.

(Related: 10 Smart Ways to Save Money Without Feeling Restricted)

2. Pay Yourself First

Before you pay bills, before you shop, pay yourself.

This means automatically transferring a portion of your income into savings or investments the moment you get paid.

Most wealthy people treat saving like a non-negotiable bill.

📊 Example:

If you save 15% of your income every month for 10 years and earn an average of 7% annually — you’ll have nearly double what a “save-what’s-left” spender will ever accumulate.

💬 Automation is key. Set it, forget it, and let time do the heavy lifting.

3. Invest Consistently — Even in Small Amounts

You don’t need to be rich to start investing — you get rich by investing.

The earlier you begin, the more compound interest works in your favor.

📈 Example:

Investing $200 a month at 8% annual growth will grow to over $365,000 in 30 years.

Consistency beats perfection.

Whether it’s ETFs, index funds, or crypto — what matters is building the habit of regular contributions, not market timing.

(Related: Understanding ETFs: The Smart Way to Diversify)

4. Avoid Lifestyle Inflation

Every time your income increases, your spending tends to follow — this is called lifestyle inflation.

It’s the silent killer of long-term wealth.

The key? When you get a raise, don’t increase your lifestyle by the same amount.

Instead:

- Save or invest 50% of the raise.

- Treat yourself with the rest (you earned it).

🧠 Discipline now creates freedom later.

Let your money grow faster than your lifestyle.

5. Build Multiple Income Streams

Relying on one paycheck is risky — one layoff, and your income disappears.

Rich people understand this deeply: diversification isn’t just for investments, it’s for income.

Examples of extra income streams:

- Freelance work or side hustles

- Real estate or dividend-paying stocks

- Selling digital products or online courses

- Affiliate marketing or e-commerce

💡 Goal: Build at least 3 sources of income — even if small. Over time, they compound like investments.

(Related: How to Start a Profitable Side Hustle in 2025)

6. Stay Out of Bad Debt

Not all debt is equal.

Debt that grows your wealth (like property, education, or business investment) can be good.

Debt that funds consumption — that’s wealth poison.

If you’re carrying credit card balances, high-interest loans, or personal debt, focus on clearing them before investing heavily.

💬 Pro Tip:

Use the avalanche method (pay highest-interest debt first) or the snowball method (start with smallest balance for motivation).

Once you’re debt-free, redirect those payments into your savings or investments — that’s how wealth snowballs.

7. Think Long-Term, Not Instant Gratification

The rich don’t think in weekends or months — they think in decades.

They delay gratification today to enjoy compounding freedom tomorrow.

📆 Instead of asking:

“What can I buy right now?”

Ask:

“What will this money be worth if I invest it instead?”

If you start investing at 25 instead of 35, you’ll have almost double the wealth by retirement — without saving a penny more.

🧠 Patience is the secret ingredient that turns small habits into big results.

Final Thought

Wealth isn’t built overnight — it’s built habit by habit.

Spend wisely, save automatically, invest consistently, and protect yourself from unnecessary debt.

It’s not about being perfect — it’s about being intentional.

As Warren Buffett said:

“Do not save what is left after spending; instead, spend what is left after saving.”

Start today.

Ten years from now, you’ll thank yourself for it.

Pingback: Best High-Yield Savings Accounts in the U.S. (2025 Update)

Pingback: low-income budget hacks that actually work in 2025

Pingback: Living Paycheck to Paycheck: How to Break the Cycle in 2025