Life is unpredictable — but your finances don’t have to be.

Medical bills, car repairs, sudden job loss, or urgent travel can destroy your budget overnight if you’re not prepared. That’s why an emergency fund is one of the most important foundations of personal finance.

If you’re currently living paycheck to paycheck, an emergency fund isn’t a “nice-to-have” — it’s what stops every surprise from turning into debt.

In this guide, you’ll learn exactly how much you really need, where to keep it, and how to build it step by step in a realistic way for 2026.

Why Emergency Funds Matter (Especially If You’re Living Paycheck to Paycheck)

If you’re living paycheck to paycheck, even a small unexpected expense can trigger a chain reaction:

- credit card debt

- late fees

- stress

- more financial instability next month

That’s why emergency funds are so powerful. They don’t just cover expenses — they protect your cash flow.

If budgeting feels impossible because every dollar is already committed, this complete guide explains how to break that cycle and stabilize your finances first:

👉 Living Paycheck to Paycheck: How to Break the Cycle in 2025

Once you have even a small emergency buffer, everything else — budgeting, saving, debt payoff — becomes easier.

1. What Is an Emergency Fund (and What It’s NOT)

An emergency fund is cash set aside only for unexpected, urgent expenses.

It is:

- a financial safety net

- protection against high-interest debt

- peace of mind during uncertainty

It is NOT for:

- vacations

- new phones or gadgets

- regular monthly bills

- investments or “opportunities”

💡 Think of your emergency fund as financial insurance you pay to yourself.

Without one, even a minor emergency can spiral into long-term debt.

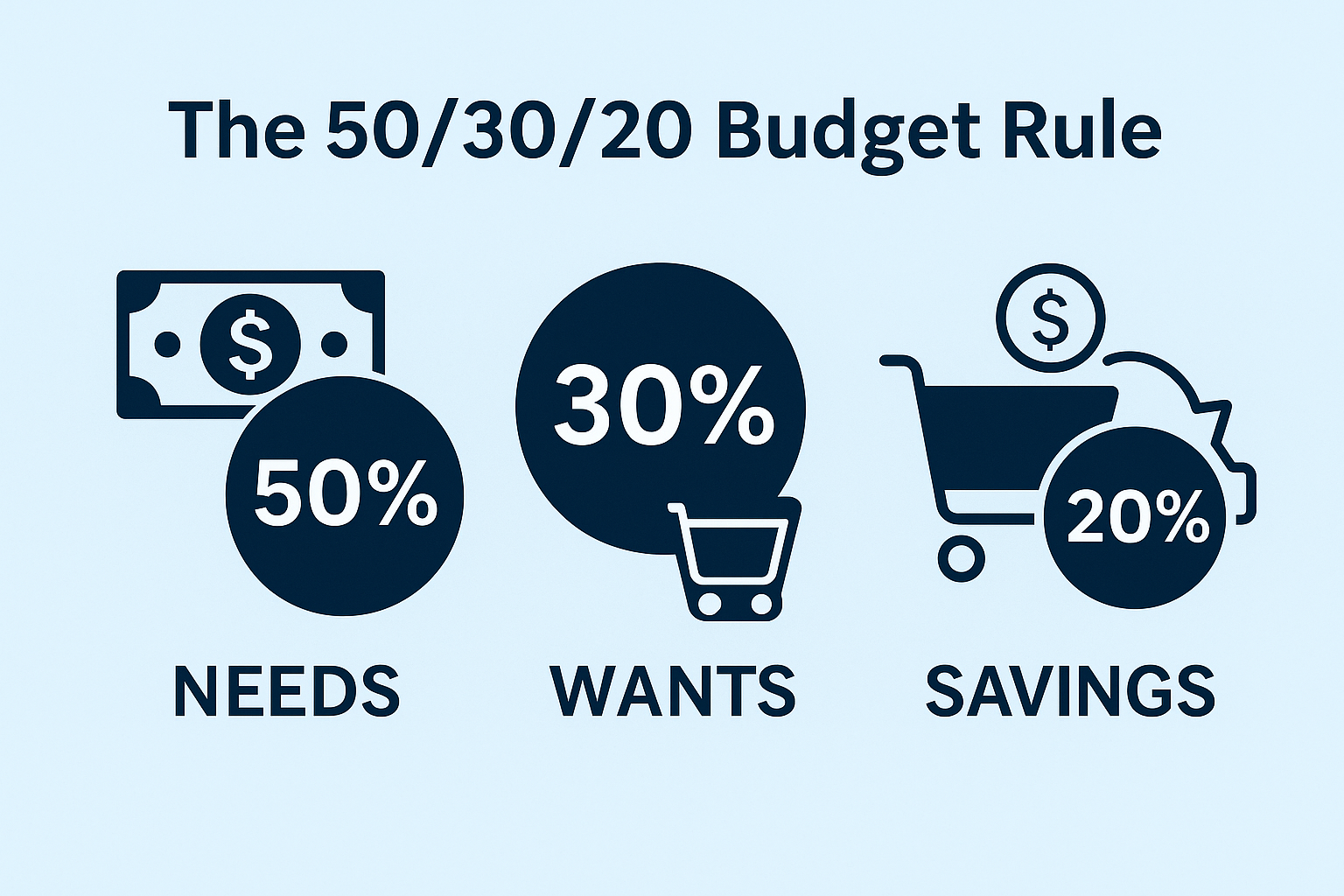

(Related: The 50/30/20 Budget Rule Explained for Beginners)

2. How Much Emergency Fund Do You Really Need?

You’ve probably heard the standard advice:

“Save 3–6 months of expenses.”

That’s a good guideline — but it’s not universal.

The 3–6 Month Rule Explained

If your essential monthly expenses are $2,000:

- 3 months = $6,000

- 6 months = $12,000

But the right amount depends on your situation.

You may only need 3 months if:

- you have a stable full-time job

- you live in a dual-income household

- your expenses are predictable

- you have low debt

You may need 6–12 months if:

- you’re self-employed or freelance

- your income fluctuates

- you support dependents

- you have health-related expenses

- you live in a high-cost city

🧠 SEO-important insight:

If you’re living paycheck to paycheck, do NOT start with 3–6 months. That goal is overwhelming and often stops people from starting at all.

3. Start With a Starter Emergency Fund ($300–$1,000)

Before worrying about months of expenses, build a starter emergency fund.

Why this works

A small buffer:

- prevents new debt

- absorbs common surprises

- reduces stress immediately

Recommended first targets:

- $300 → covers many minor emergencies

- $500 → strong psychological safety

- $1,000 → solid first milestone

This is the fastest way to move out of survival mode.

👉 This approach fits perfectly with a realistic monthly plan:

How to Create a Monthly Budget That Actually Works in 2025

4. Where to Keep Your Emergency Fund (2026 Options)

Your emergency fund should be:

- safe

- liquid

- boring

Best options in 2026

High-Yield Savings Account (HYSA)

- 4–5% APY

- FDIC insured

- instant access

- ideal for most people

Money Market Account

- similar safety

- slightly higher yields

- sometimes check-writing access

Cash Management Accounts

- offered by fintechs

- combine checking + savings features

⚠️ Avoid keeping emergency funds in:

- stocks

- crypto

- real estate

- long-term investments

Market volatility defeats the purpose of an emergency fund.

(Related: Best High-Yield Savings Accounts in the U.S. (2025 Update))

5. How to Build Your Emergency Fund Step by Step

Building a financial safety net isn’t about big deposits — it’s about consistency.

Step 1: Calculate your essential expenses

Include only:

- housing

- food

- utilities

- insurance

- transportation

Step 2: Set clear milestones

- Starter fund: $500–$1,000

- Next goal: 1 month of expenses

- Long-term goal: 3–6 months

Step 3: Automate everything

- save on payday

- even $25–$50 per week matters

Step 4: Treat it like a non-negotiable bill

Savings come before discretionary spending.

💰 Example:

Saving $200/month = $2,400 in one year.

That’s real financial protection.

6. When You SHOULD (and Shouldn’t) Use Your Emergency Fund

Use it for:

- job loss or income disruption

- medical or dental emergencies

- urgent car or home repairs

- family emergencies

Do NOT use it for:

- holidays or birthdays

- lifestyle upgrades

- investments

- routine monthly expenses

📌 Rule of thumb:

If it’s unexpected, urgent, and necessary, it qualifies.

7. How Emergency Funds Help You Stop Living Paycheck to Paycheck

This is where emergency savings become transformative.

With a buffer:

- you stop relying on credit cards

- your budget stops breaking every month

- unexpected bills don’t cause panic

- cash flow becomes predictable

This stability is the foundation for escaping the paycheck-to-paycheck cycle.

👉 For the full system, read:

Living Paycheck to Paycheck: How to Break the Cycle in 2025

Once the cycle is broken, saving and investing become exponentially easier.

8. Refill and Reassess Over Time

Your financial safety net isn’t static.

Reassess when:

- you change jobs

- your income changes

- you move cities

- you add dependents

- you take on new debt

At least once per year:

- recalculate expenses

- adjust your target

- top it up if needed

📊 Pro tip:

Keep your emergency fund in a separate account so you’re not tempted to touch it.

FAQs About Emergency Funds

How much emergency fund should I have if I live paycheck to paycheck?

Start with $300–$500. This small buffer prevents new debt and gives immediate relief.

Should I save or pay off debt first?

Build a starter emergency fund first, then focus on high-interest debt. Without a buffer, debt tends to return.

Can I invest my emergency fund?

No. Emergency funds should be stable and liquid, not exposed to market risk.

How long does it take to build an emergency fund?

With consistent saving, many people build a starter fund in 2–3 months and one month of expenses within a year.

Final Thought: Emergency Funds Create Freedom, Not Fear

An emergency fund isn’t about expecting the worst — it’s about being ready for reality.

It gives you:

- peace of mind

- negotiating power

- freedom to make better decisions

- protection against financial setbacks

Start small. Automate consistently. Protect it fiercely.

Because financial security doesn’t come from luck —

it comes from preparation.

(Related: 10 Smart Ways to Save Money Without Feeling Restricted)

Pingback: How to Build Good Credit from Scratch

Pingback: How to create a monthly budget that works

Pingback: low-income budget hacks that actually work in 2025

Pingback: Living Paycheck to Paycheck: How to Break the Cycle in 2025