Everyone knows they should have a monthly budget — but far fewer manage to stick to one.

Most people either give up after a few weeks or end up with a spreadsheet that looks good but never reflects real life. In 2026, with rising living costs, subscriptions everywhere, and unpredictable income streams, having a monthly budget that actually works isn’t optional anymore — it’s essential.

The good news? You don’t need to be a finance expert or hyper-disciplined.

You just need a budgeting system that’s simple, realistic, and flexible enough to work in the real world.

Table of Contents

Why Budgeting Feels Impossible for So Many People

If you’ve tried budgeting before and it never seems to stick, the problem may not be your budget — it may be that you’re living paycheck to paycheck.

When every dollar is already committed to bills, traditional budgeting advice often fails. There’s no margin for error, and one unexpected expense can break the entire plan.

If that sounds familiar, this step-by-step guide explains how to fix the root problem first and regain financial stability:

👉 Living Paycheck to Paycheck: How to Break the Cycle in 2025

Once that foundation is in place, a monthly budget becomes far easier to maintain.

1. Start With Your Real Numbers, Not Estimates

Before deciding where your money should go, you need to see where it’s actually going.

Track your spending for 30 days

Use tools like:

- Mint

- You Need A Budget (YNAB)

- Google Sheets

Focus on accuracy, not perfection. Track everything:

- groceries

- gas

- subscriptions

- small impulse purchases

Most people discover:

- subscriptions they forgot about

- categories where they overspend without realizing

- easy opportunities to save immediately

(Related: 10 Smart Ways to Save Money Without Feeling Restricted)

2. Calculate Your Monthly Income (The Right Way)

This step seems obvious — but it’s where many budgets fail.

Include:

- take-home salary (after taxes)

- side hustles or freelance income

- commissions, tips, or bonuses

- passive income (dividends, rental income)

If your income fluctuates

If you’re self-employed or paid hourly:

- calculate a 3-month average, or

- budget using your lowest recent month

This keeps your monthly budget realistic and prevents constant frustration.

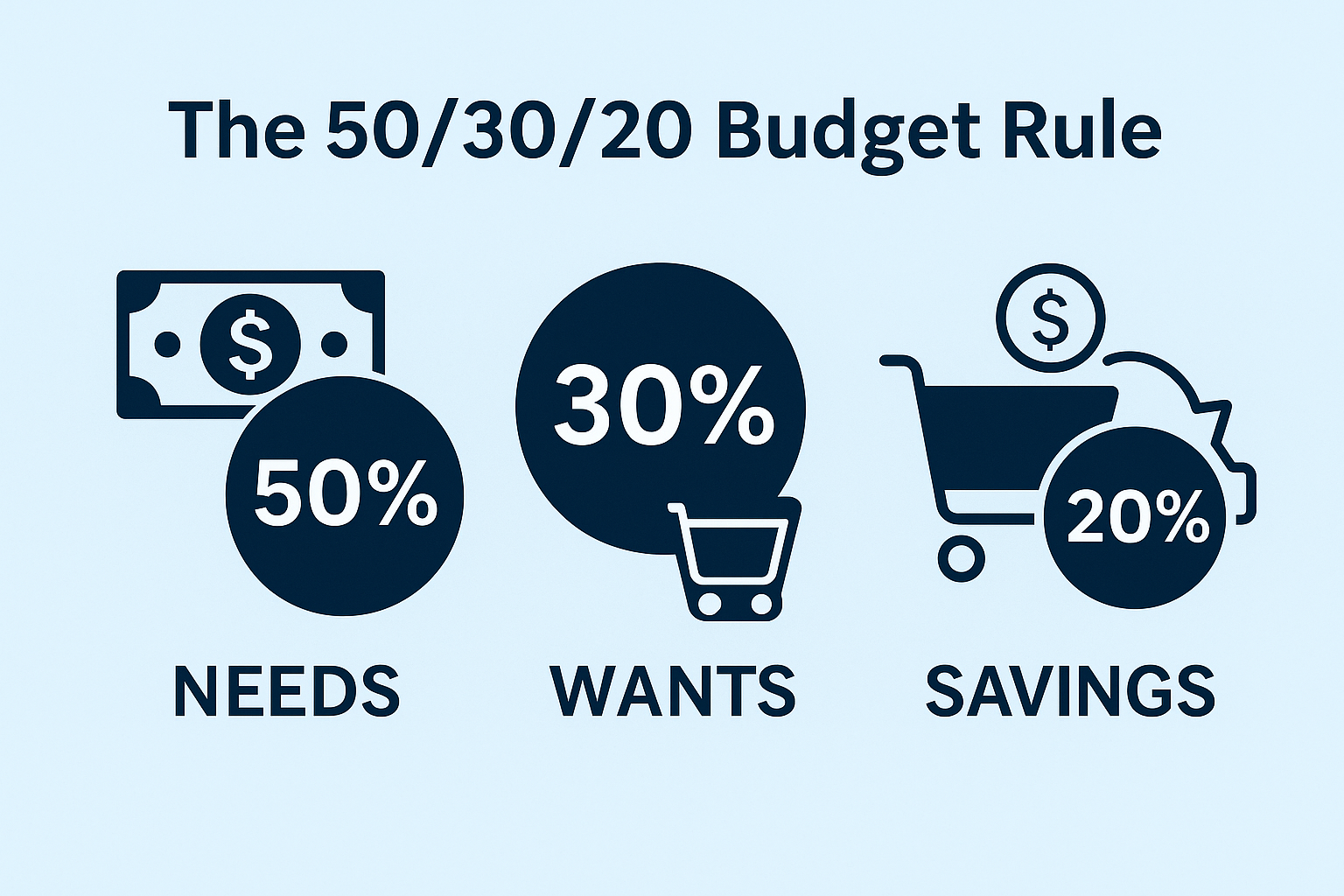

3. Use the 50/30/20 Rule as a Flexible Foundation

The 50/30/20 budget rule remains one of the simplest and most effective frameworks in 2026.

Basic structure:

- 50% Needs (rent, food, bills)

- 30% Wants (entertainment, dining, travel)

- 20% Savings & Debt

Example on a $4,000 monthly income:

- Needs: $2,000

- Wants: $1,200

- Savings/Debt: $800

💡 Adjust as needed. If rent is high, you might use 55/25/20 instead.

(Related: The 50/30/20 Budget Rule Explained for Beginners)

Why Monthly Budgets Fail When You’re Living Paycheck to Paycheck

Monthly budgeting often fails not because people lack discipline, but because cash flow leaves no room for error.

When rent, groceries, utilities, and debt payments consume most of your income, even a well-designed budget becomes fragile. One unexpected expense — a car repair, medical bill, or delayed paycheck — can derail the entire month.

This is why many people feel like budgeting “doesn’t work” for them. The real issue isn’t the budget itself, but the lack of financial buffer and flexibility.

Before optimizing categories and percentages, it’s essential to stabilize your cash flow and build small safety margins. Once that foundation exists, a monthly budget becomes far easier to maintain.

4. Prioritize Saving Before Spending

Most people try to save whatever is “left over” — which usually means saving nothing.

Flip the system:

- Pay yourself first

- Automate savings right after payday

A simple starting split:

- 10% emergency fund

- 5% long-term investments

- 5% short-term goals

Even small, automated transfers compound into real stability over time.

(Related: Emergency Fund 101: How Much Do You Really Need?)

5. Simplify Your Spending Categories

Overcomplicated budgets fail because they require constant attention.

Stick to 5–7 categories max:

- Housing

- Transportation

- Food

- Entertainment

- Savings/Debt

- Miscellaneous

Use apps that visualize spending automatically, such as:

- YNAB

- Monarch Money

- PocketGuard

Simplicity is what makes a monthly budget sustainable.

6. Adjust Your Budget Every Month (Not Once a Year)

Life changes — your budget should too.

Each month, ask:

- Where did I overspend?

- Where did I underspend?

- Did my income change?

- What can I adjust next month?

A 10-minute monthly review is enough to keep your budget aligned with reality.

7. Use Technology to Stay Consistent

Budgeting fails most often because people forget to maintain it.

In 2026, automation solves that problem:

- YNAB teaches intentional spending

- Cleo uses AI reminders and humor

- Copilot Money analyzes patterns automatically

Automation removes friction — and consistency beats motivation every time.

FAQs About Monthly Budgeting

Why doesn’t my monthly budget work?

Usually because expenses are underestimated or cash flow is too tight. Stabilizing essentials and building a small buffer makes budgeting far more effective.

How often should I update my monthly budget?

At least once per month. More often if your income fluctuates.

Is a monthly budget enough if I live paycheck to paycheck?

A monthly budget helps, but it works best when combined with cash flow stabilization and emergency savings.

Final Thought: A Budget Is a Tool, Not a Restriction

A monthly budget that works isn’t about saying “no” to everything — it’s about telling your money where to go instead of wondering where it went.

Start small. Track honestly. Adjust often.

Because the goal isn’t to live cheaply —

it’s to live intentionally and build stability over time.

(Related: How to Pay Off Credit Card Debt Fast in 2025)

Pingback: AI money-making tools for beginners

Pingback: low-income budget hacks that actually work in 2025

Pingback: Emergency Fund 101: How Much Do You Really Need? - Prime Finance Insights