Managing money doesn’t have to mean giving up everything you love. Saving smartly is about strategy — not sacrifice. Whether you’re planning for financial freedom, an emergency fund, or just trying to stop living paycheck to paycheck, here are 10 practical ways to save money without feeling restricted.

1. Automate Your Savings

The best way to save is to remove temptation. Set up automatic transfers from your checking account to your savings account right after every payday. This way, you save before you spend — not after.

💡 Tip: Even transferring 10% of your income automatically can lead to thousands saved yearly without even noticing.

2. Track Your Spending with Apps

You can’t manage what you don’t measure. Use apps like Mint, YNAB (You Need A Budget) or Personal Capital to monitor where your money goes.

Once you see those hidden subscriptions or $6 daily coffees, you’ll make smarter spending decisions naturally.

3. Cut Recurring Costs (Not Joy)

You don’t need to cut Netflix — just cut what you don’t use. Audit your monthly subscriptions every 2-3 months.

If you haven’t used a service in 30 days, cancel it. Then, redirect that amount straight into your savings account or an ETF.

4. Cook More, Order Less

Food delivery might save time, but it’s a silent wallet killer. Cooking at home even three more times a week can save you over $150/month.

Try batch cooking on Sundays — it keeps your diet and your budget under control.

5. Switch to High-Yield Savings Accounts

Don’t let your cash sleep in a 0.01% interest account. Move it to a high-yield savings account (HYSA) that offers 4–5% APY.

Platforms like Ally, SoFi, or Capital One 360 let you earn while keeping your money accessible.

(Related: Best High-Yield Savings Accounts in the U.S. (2025 Update))

6. Set Short-Term Goals

Saving is easier when you know why. Set specific goals like:

- $1,000 emergency fund

- A weekend trip fund

- 3 months’ rent saved

Break your long-term dreams into small, achievable steps — you’ll stay motivated and consistent.

7. Shop Smarter — Not Cheaper

Being frugal isn’t buying the cheapest; it’s buying the best value.

Before buying, compare lifetime cost, not just price.

Use extensions like Honey or Rakuten to catch deals automatically while shopping online.

8. Reduce “Invisible” Bank Fees

Most people lose hundreds per year on overdrafts and ATM charges.

Choose a fee-free bank, or switch to a digital bank like Chime or Revolut that doesn’t penalize small balances.

9. Embrace the “24-Hour Rule”

Impulse buying is a savings killer.

Before making a non-essential purchase, wait 24 hours.

You’ll be surprised how often the urge disappears — and your balance stays healthy.

10. Build Habits, Not Restrictions

Saving shouldn’t feel like punishment. It’s about designing a system where spending less happens automatically.

Once you automate, track, and visualize progress, saving becomes second nature — not a daily battle.

Final Thought

You don’t need to be rich to start saving; you need to start saving to become rich.

Smart financial habits compound — just like investments. Start with one small change today and build from there.

(Also read: 7 Financial Habits That Will Make You Rich Over Time)

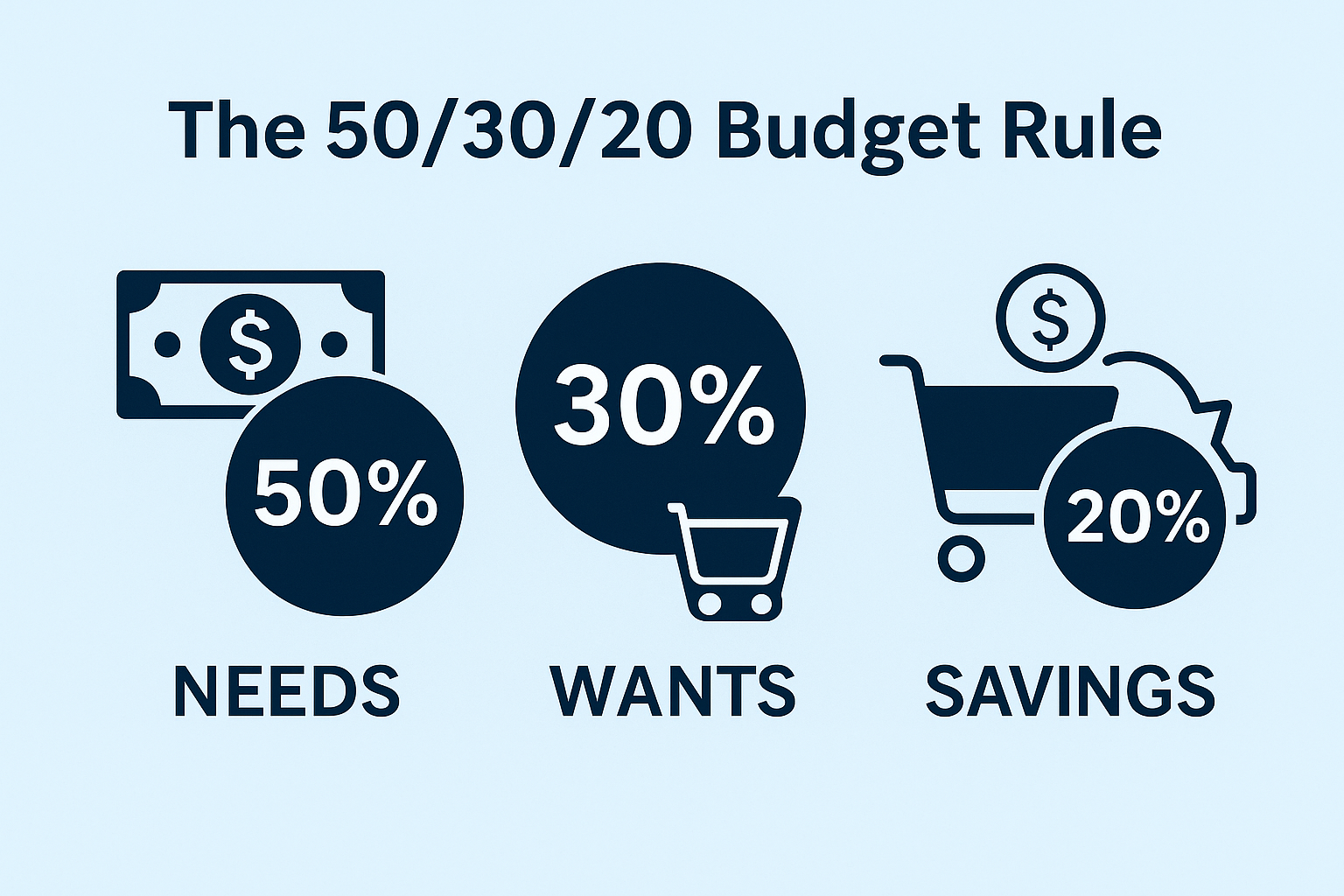

Pingback: The 50/30/20 Budget Rule Explained for Beginners

Pingback: 7 Financial Habits That Will Make You Rich Over Time

Pingback: How to Create a Monthly Budget That Actually Works in 2025

Pingback: Emergency Fund 101: How Much Do You Really Need?

Pingback: AI money-making tools for beginners